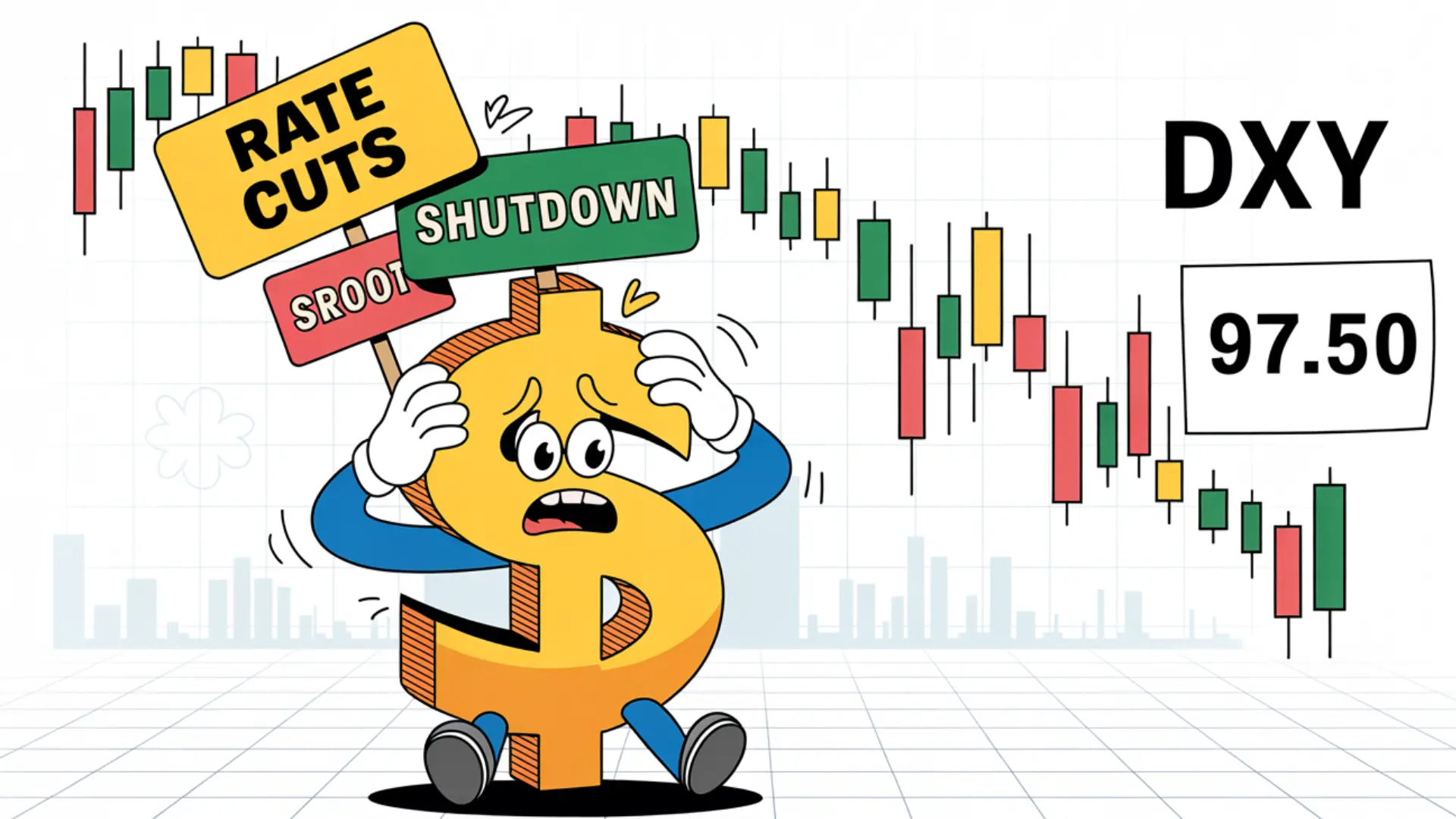

Will DXY Extend Losses After Dropping to 97.50?

DXY falls to 97.50, a one-week low, on Fed rate cut bets and U.S. shutdown concerns.

The US Dollar Index (DXY), which measures the Greenback against a basket of currencies, extended its decline for a fourth consecutive day, dropping to a one-week low near the mid-97.00s, down roughly 0.35% on the day. The index appears vulnerable to further weakness amid mounting negative factors.

Despite cautious remarks from Federal Reserve Chair Jerome Powell, markets continue to price in the likelihood of two additional rate cuts this year. The CME FedWatch Tool shows nearly a 95% chance of a reduction at the October FOMC meeting and over a 75% probability of another in December. Coupled with the partial US government shutdown, these expectations weigh on the USD and reinforce a bearish near-term outlook.

The shutdown was triggered after a Republican spending bill failed in the Senate on Tuesday, halting government operations from 04:00 GMT Wednesday. Immediate consequences include potential delays in key US macroeconomic releases, such as Friday’s Nonfarm Payrolls report, while a prolonged shutdown could further dampen economic performance, supporting additional downside pressure on the US Dollar.