US Dollar Steady as Trump Delays Tariff Deadline

US Dollar holds steady as market sentiment adjusts to Trump’s extended tariff timeline.

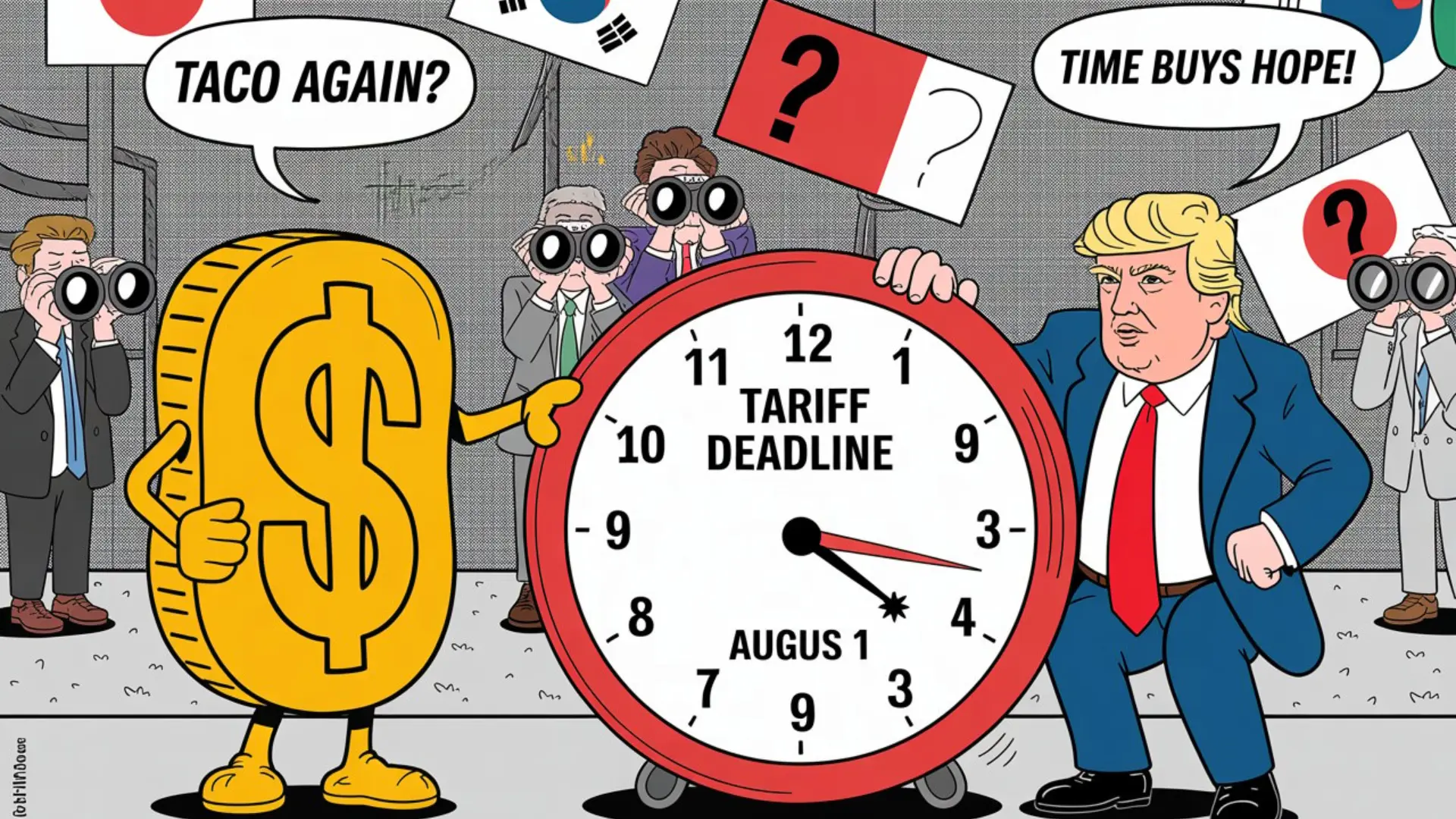

The US Dollar (USD) remains steady on Tuesday, struggling to extend Monday’s tariff-driven gains as market sentiment stabilizes following President Donald Trump’s decision to delay the tariff deadline from July 9 to August 1.

Trump posted trade warning letters late Monday on Truth Social, targeting 14 countries—including Japan and South Korea—with potential “reciprocal” tariffs starting August 1. While the initial news lifted the USD on safe-haven demand, the extended deadline has given markets hope for further negotiations, leading to a slight pullback in the Dollar’s momentum.

The US Dollar Index (DXY), which tracks the USD against six major currencies, is holding firm during the European session. After dipping to an intraday low of 97.18 during Asian trading, it has recovered modestly and is currently hovering around 97.47, reflecting a cautious tone as investors await more clarity on the trade outlook.

The delay has reignited market skepticism, with some traders reviving the acronym “TACO” – Trump Always Chickens Out – to highlight a recurring pattern of aggressive tariff rhetoric followed by deadline extensions or softer measures. This has dampened the initial safe-haven demand for the US Dollar, as investors anticipate that a prolonged timeline might favor negotiations over immediate escalation.

Beyond short-term reactions, the US Dollar faces ongoing pressure from deepening fiscal concerns, including surging government debt and questions about long-term economic stability. With US public debt nearing $30 trillion and the 2025 federal deficit projected to approach $2 trillion, global investors are increasingly uneasy about the sustainability of the U.S. fiscal trajectory.

Adding to the strain, Trump’s criticism of the Federal Reserve and rising expectations of rate cuts are weighing further on the Greenback. According to CME FedWatch, 30-day Fed funds futures are now pricing in 100 basis points of rate reductions over the next year, potentially bringing the target range down to 3.25%–3.50%.