NZD/USD Nears 0.5960 as Dovish Fed Pressures US Dollar.

NZD/USD edges higher toward 0.5960 as dovish Fed expectations pressure the US Dollar.

FUNDAMENTAL OVERVIEW:

The NZD/USD pair edged up toward 0.5960 in late European trading on Monday, supported by US Dollar weakness as markets bet on a Fed rate cut this Wednesday. The US Dollar Index (DXY) slipped 0.2% to around 97.40, reflecting selling pressure on the Greenback.

According to the CME FedWatch tool, traders have fully priced in a rate cut, driven by mounting labor market concerns in the US. Initial Jobless Claims rose to 263K for the week ending September 5—the highest level in four years—further fueling dovish Fed expectations. Markets will closely monitor the Fed’s guidance for the policy outlook through the rest of the year.

On the other hand, the New Zealand Dollar’s trajectory remains uncertain amid expectations of further easing by the Reserve Bank of New Zealand (RBNZ). Reuters reported that the RBNZ is likely to cut the Official Cash Rate (OCR) two more times this year, after already reducing it by 125 basis points to 3% in 2025.

NZD/USD TECHNICAL ANALYSIS CHART:

Technical Overview:

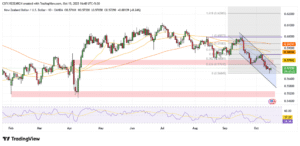

NZD/USD is trading within an up channel.

NZD/USD is moving above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in a Bullish Zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 0.5996

Immediate support level: 0.5914

HOW TO TRADE NZD/USD

After an initial surge, NZD/USD retreated to test a key support level before rebounding and breaking above its prior major resistance. The pair now trades above that zone, and if it sustains support during the current pullback, it could extend its uptrend toward a higher resistance level.