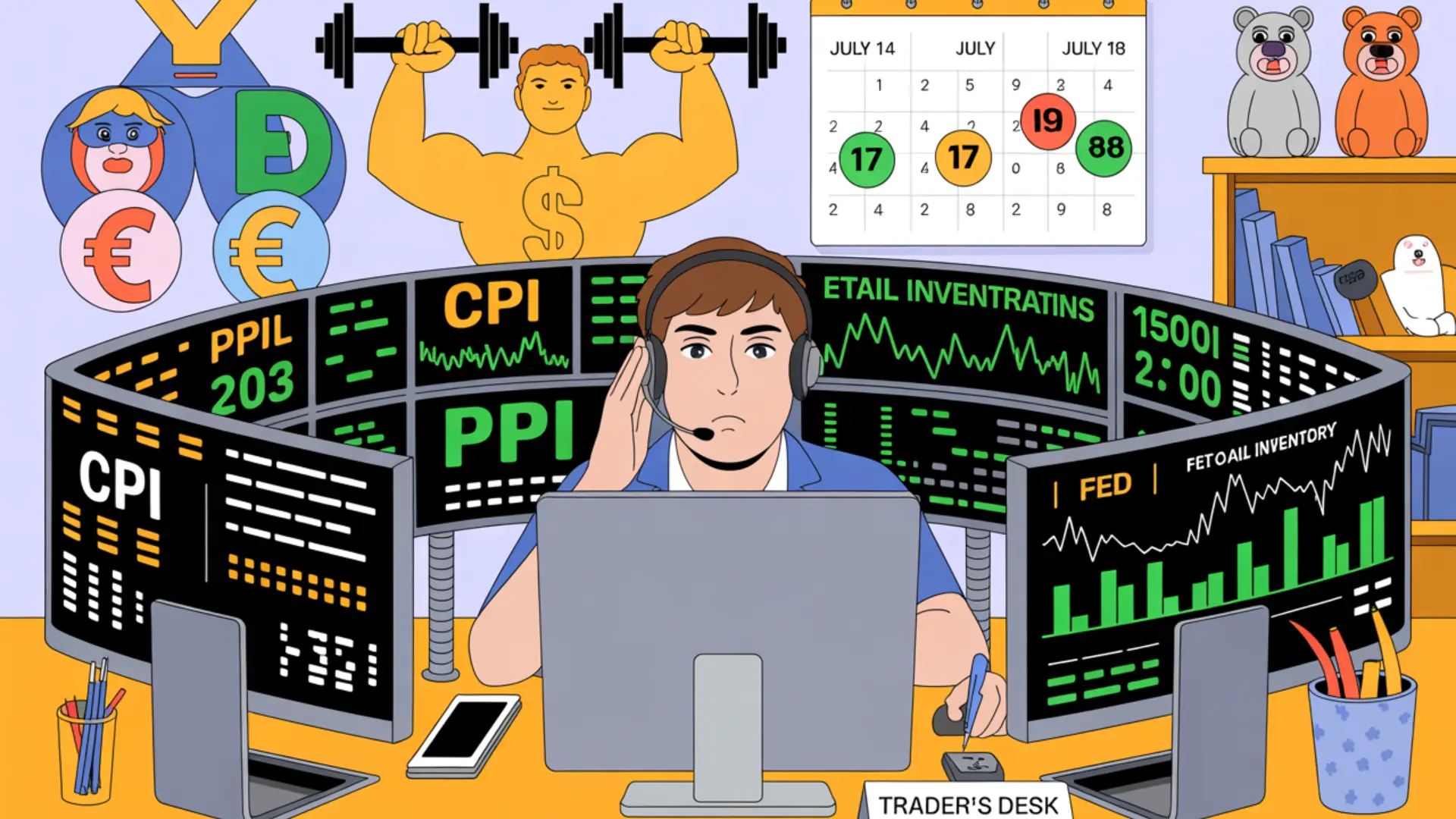

Markets Eye US CPI, Fed Talks & Global Data This Week

Looking ahead to the coming week, all eyes will be on the U.S. Consumer Price Index (CPI) data

The US dollar (USD) traded with a firmer tone this week, partially recovering from its recent steep losses as renewed tariff concerns and reduced expectations of a Fed rate cut in July provided support.

The US Dollar Index (DXY) rose to its monthly high on Friday, stopping just below the key 98.00 level. Attention now turns to a busy data calendar, led by the July 15 release of the Inflation Rate, followed by the NY Empire State Manufacturing Index and API’s weekly US crude oil inventory data. On July 16, markets will focus on Producer Prices, MBA Mortgage Applications, Industrial and Manufacturing Production, Capacity Utilisation, EIA’s crude oil report, and the Fed’s Beige Book. July 17 brings Initial Jobless Claims, the Philly Fed Manufacturing Index, Export and Import Prices, Retail Sales, NAHB Housing Market Index, Business Inventories, and TIC Flows. The week concludes on July 18 with reports on Housing Starts, Building Permits, and preliminary University of Michigan Consumer Sentiment.

EUR/USD gave back some of its recent gains and ended the week in negative territory, though it managed to stay above the 1.1700 level. Key eurozone data begins July 15 with the ZEW Economic Sentiment for Germany and the broader region, followed by bloc-wide Industrial Production. On July 16, the focus shifts to the euro area’s Balance of Trade, while the final Inflation Rate reading for the region will take the spotlight on July 17. Germany’s Producer Prices, EMU Current Account, and Construction Output are due on July 18.

GBP/USD had a downbeat week, dropping to two-week lows and slipping below 1.3600 amid lingering UK fiscal concerns and renewed strength in the US dollar. The BRC Retail Sales Monitor is due on July 15, followed by the UK Inflation Rate on July 16 and the labor market report on July 17.

USD/JPY broke a two-week losing streak, climbing back above the 147.00 mark by Friday. Japan’s data schedule includes Machinery Orders, Capacity Utilization, Industrial Production, and the Tertiary Industry Index on July 14. The Reuters Tankan Index, Trade Balance, and Foreign Bond Investment figures are due on July 17, with Inflation data on July 18.

AUD/USD eased slightly on Friday after reaching new yearly highs around the 0.6600 level. Westpac Consumer Confidence is due on July 15, while Consumer Inflation Expectations and the critical Australian jobs report are scheduled for July 17.

Upcoming Economic Voices:

- ECB’s Cipollone speaks on July 14.

- On July 15, remarks are expected from ECB’s Buch, BoE’s Bailey, and Fed officials Barr, Bowman, and Collins.

- Fed’s Logan, Hammack, and Barr speak on July 16.

- Fed’s Williams, Daly, Kugler, and Cook are scheduled for July 17.

- Fed’s Waller and ECB’s Nagel will speak on July 18.

Central Bank Meetings:

- Bank Indonesia (BI) meets on July 16, with a decision of 5.50% vs. the expected 5.25%.