US Dollar Weekly Forecast: Opportunity or Risk Ahead.

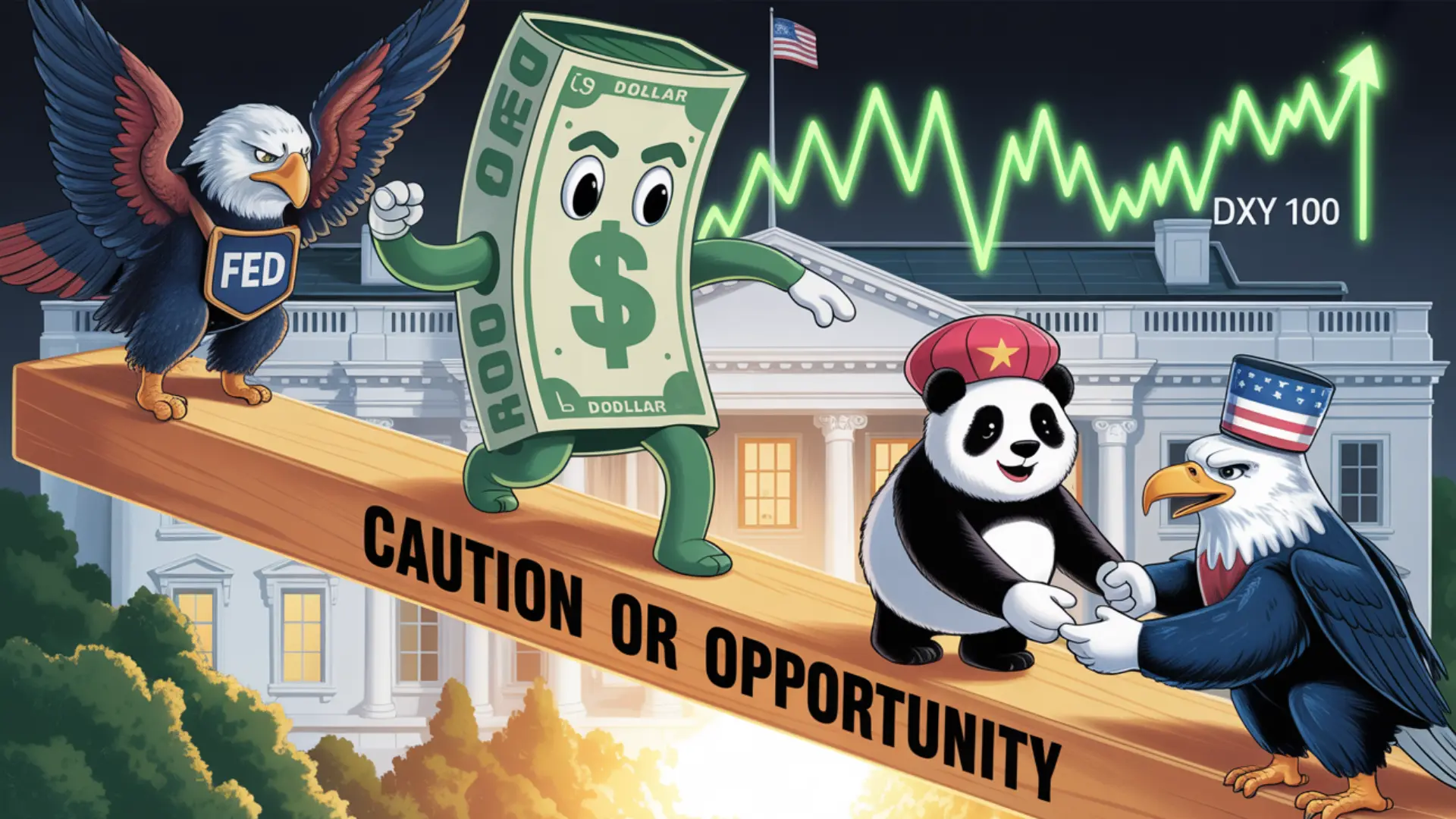

US Dollar Weekly Forecast: Caution or Opportunity Ahead?

Market Overview

The US Dollar (USD) ended the week on a stronger note, reversing early weakness as optimism surrounding a potential US–China trade agreement and a cautious tone from Federal Reserve (Fed) Chair Jerome Powell supported demand for the Greenback.

Following the Fed’s widely anticipated decision to cut the Fed Funds Target Range (FFTR) by 25 basis points to 3.75%–4.00%, the US Dollar Index (DXY) rebounded sharply, approaching the 100.00 level, its highest point in two months. The rally marked a decisive turnaround from the multi-year lows seen earlier this quarter.

The recovery was further bolstered by progress in trade diplomacy. The Trump–Xi meeting in South Korea resulted in a temporary truce that calmed markets, even as the ongoing US government shutdown—now in its fifth week—cast a shadow over the broader economic outlook.

Powell’s Hawkish Pivot

The Federal Reserve’s rate cut decision passed with a 10–2 vote, signaling growing division within the central bank. Alongside the rate adjustment, the Fed announced limited Treasury purchases to improve liquidity.

During his press conference, Chair Jerome Powell warned markets not to expect another rate cut in December, despite lingering signs of economic cooling. Futures markets currently price in about 17 basis points of additional easing by year-end and around 82 basis points through 2026.

Powell emphasized that future policy moves will depend on the trajectory of inflation, which has shown signs of stabilization, and the resilience of the labor market, which remains strong despite the fiscal uncertainty caused by the shutdown.

Divided Voices at the Fed

Fed officials remain split on the path forward. Kansas City Fed President Jeffrey Schmid and Dallas Fed President Lorie Logan opposed the latest rate cut, citing sticky inflation and solid employment data.

In contrast, Atlanta Fed President Raphael Bostic urged a data-dependent approach, suggesting that while inflation has eased, the Fed should not commit to additional cuts prematurely. The divergence of views highlights the challenge facing policymakers as they attempt to navigate a soft-landing scenario without reigniting inflation.

Shutdown Stalemate Deepens

The federal government shutdown, now entering its fifth week, continues to weigh on sentiment. Prolonged fiscal paralysis has delayed economic data releases, disrupted federal services, and left hundreds of thousands of workers unpaid.

The shutdown is already feeding through to the real economy, with hiring activity slowing and GDP forecasts edging lower. If it extends beyond November 5, it will become the longest shutdown in US history, further straining consumer confidence and complicating the Fed’s policy assessment.

Trade Truce but Lingering Uncertainty

While the Trump–Xi meeting yielded a temporary trade truce, the outcome was largely as expected. The US agreed to ease selected tariffs, while China pledged to increase agricultural imports, sustain rare earth exports, and tighten controls on fentanyl distribution.

Despite the progress, markets remain skeptical about the durability of the agreement. Analysts warn that structural issues—including technology transfers, industrial subsidies, and export restrictions—could resurface in the coming months, limiting the scope for a sustained trade peace.

Outlook for the Dollar

Looking ahead, the US Dollar’s trajectory will depend heavily on the interplay between Fed communication, incoming data, and fiscal developments.

The ISM Manufacturing and Services PMIs—scheduled for release next week—will offer crucial insights into underlying economic momentum. Meanwhile, investors will closely monitor Fed speeches for hints on the timing and scale of any future rate adjustments.

With the government shutdown clouding the data landscape and global trade tensions still unresolved, markets face a delicate balance: renewed risk aversion could lift the USD as a safe-haven, while improving sentiment may limit further upside.

Frequently Asked Questions (FAQ)

Q1: Why did the US Dollar strengthen last week?

The USD rose on optimism about a potential US–China trade deal and after the Federal Reserve’s cautious tone following its latest rate cut, which signaled confidence in the economy’s resilience.

Q2: What was the Fed’s latest policy action?

The Federal Reserve cut the Fed Funds Target Range by 25 basis points to 3.75%–4.00%, its second consecutive cut this year.

Q3: How is the government shutdown affecting markets?

The shutdown, now in its fifth week, is delaying key economic data, weighing on sentiment, and may begin to reduce GDP growth if it continues into November.

Q4: What happened at the Trump–Xi meeting?

Both leaders agreed to extend the trade truce, with the US easing select tariffs and China committing to increased imports and policy transparency—though long-term uncertainties remain.

Q5: What should traders watch next week?

Key events include ISM PMI releases, ongoing Fed commentary, and updates on the government shutdown, all of which could set the tone for the USD’s next move.

Disclaimer

This market outlook is provided for informational purposes only and does not constitute financial or investment advice. Economic data and market conditions are subject to rapid change. Readers should perform their own analysis or consult a licensed financial professional before making trading or investment decisions.