Dollar Sinks as Weak Jobs Data Fuels Rate Cut Bets

Dollar declines as traders’ factor in additional U.S. rate cuts following weak jobs data.

The U.S. dollar declined sharply on Friday after July’s employment data came in weaker than expected and prior job gains were significantly revised downward, prompting traders to increase their expectations for Federal Reserve rate cuts this year.

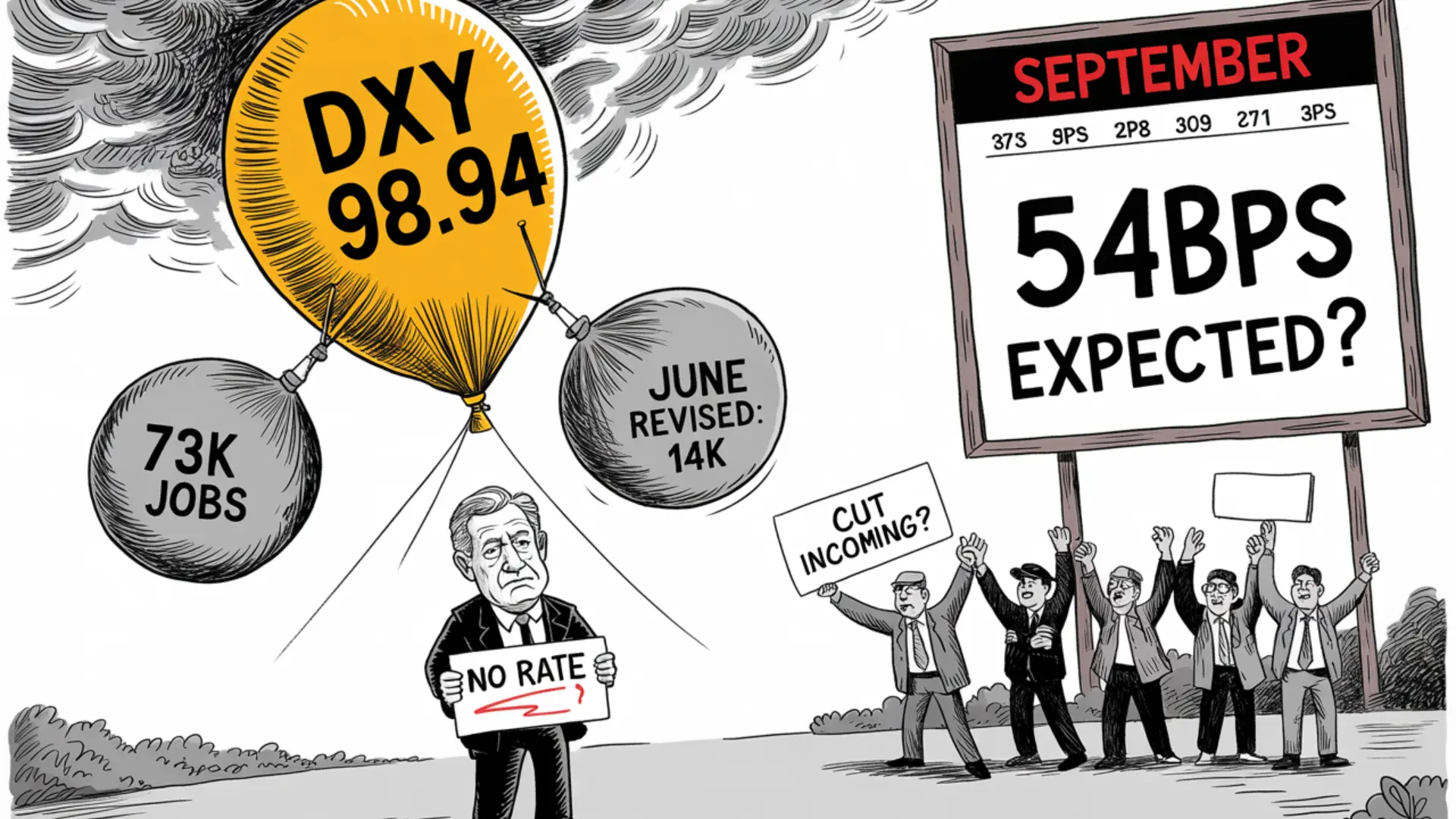

U.S. employers added just 73,000 jobs in July, well below the 100,000 forecasted by economists surveyed by Reuters. Meanwhile, the unemployment rate ticked up to 4.2% from 4.1% in June, in line with expectations. Notably, June’s job gains were revised down drastically to 14,000 from the initially reported 147,000.

Following the data release, the dollar index—which tracks the greenback against a basket of major currencies such as the euro and yen—fell 1.09% to 98.94.

Despite earlier signals from the Federal Reserve suggesting no urgency to cut rates, largely due to inflationary concerns tied to President Donald Trump’s tariff policies, market sentiment shifted after the jobs report. On Wednesday, Fed Chair Jerome Powell struck a hawkish tone, downplaying the likelihood of a rate cut in September.

However, traders reversed course on Friday, now pricing in 54 basis points of rate cuts by the end of the year—up from 34 basis points a day earlier—with expectations for the first cut in September. The dollar had initially strengthened earlier in the day following Trump’s announcement of increased tariffs on several trade partners.