US Dollar Gains on Trade Hopes and Fed Uncertainty.

The US Dollar finds support amid uncertainty surrounding the Fed and renewed optimism over trade developments.

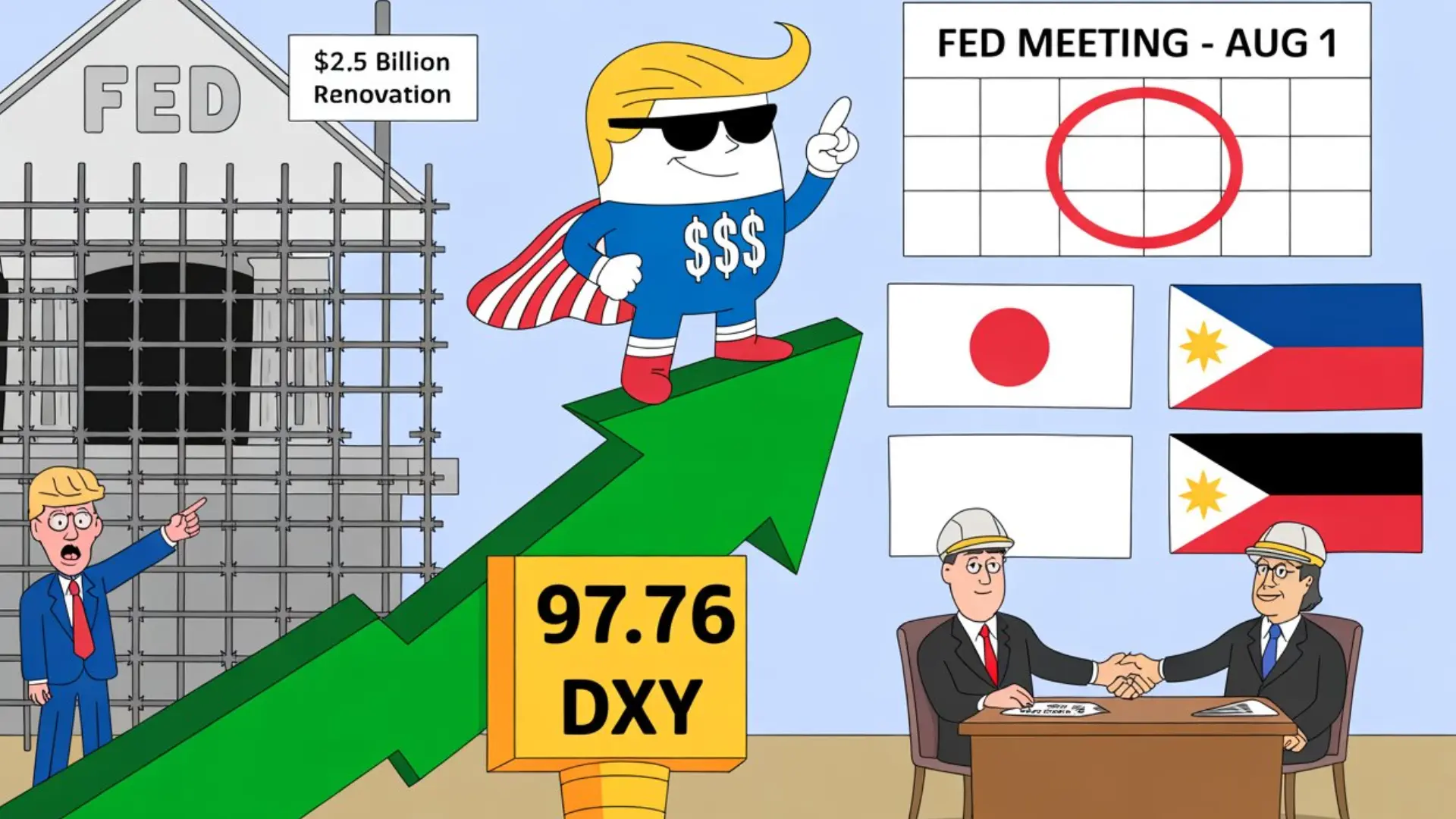

The US Dollar (USD) extended its gains for a second consecutive day on Friday, buoyed by strong US economic data and renewed trade optimism. Better-than-expected Initial Jobless Claims and steady PMI readings on Thursday helped ease recession concerns, reinforcing confidence in the resilience of the US economy. Meanwhile, positive developments in bilateral tariff negotiations with Japan, Indonesia, and the Philippines have improved market sentiment, reducing downward pressure on the Greenback.

During European trading hours, the US Dollar Index (DXY)—which tracks the USD against six major currencies—edged higher, recovering from a two-week low seen earlier in the week. At the time of writing, the index stands at 97.76, up 0.27% for the day. However, market participants remain cautious ahead of the August 1 tariff deadline and next week’s Federal Reserve policy meeting, which is keeping aggressive USD positioning in check.

In a notable development, President Donald Trump visited the Fed’s Washington headquarters on Thursday—the first such visit by a sitting president in nearly 20 years. Accompanied by Fed Chair Jerome Powell and Senator Tim Scott, Trump toured the Fed’s $2.5 billion renovation project but criticized its cost overruns. Powell clarified that the higher figure Trump cited referred to a completed structure from five years ago.

Trump also renewed his criticism of the Fed’s pace on rate cuts, stating the central bank is “moving too slowly” and should take stronger action to support growth, though he confirmed he has “no plans” to remove Powell. The visit, though framed as a tour, raised fresh questions about the Fed’s independence amid growing political pressure.

Looking ahead, markets anticipate the Fed will keep interest rates unchanged at its upcoming meeting on Wednesday. A Reuters poll shows unanimous expectations among economists that the benchmark rate will remain in the 4.25%–4.50% range, with the next potential rate move not expected before September.