U.K. Inflation Rises to 3.6% in June, Pressuring BoE

U.K. inflation came in higher than anticipated in June, with the Consumer Price Index (CPI) rising 3.6% year-over-year.

U.K. inflation rose more than expected in June, complicating the Bank of England’s efforts to steer the economy through a challenging environment.

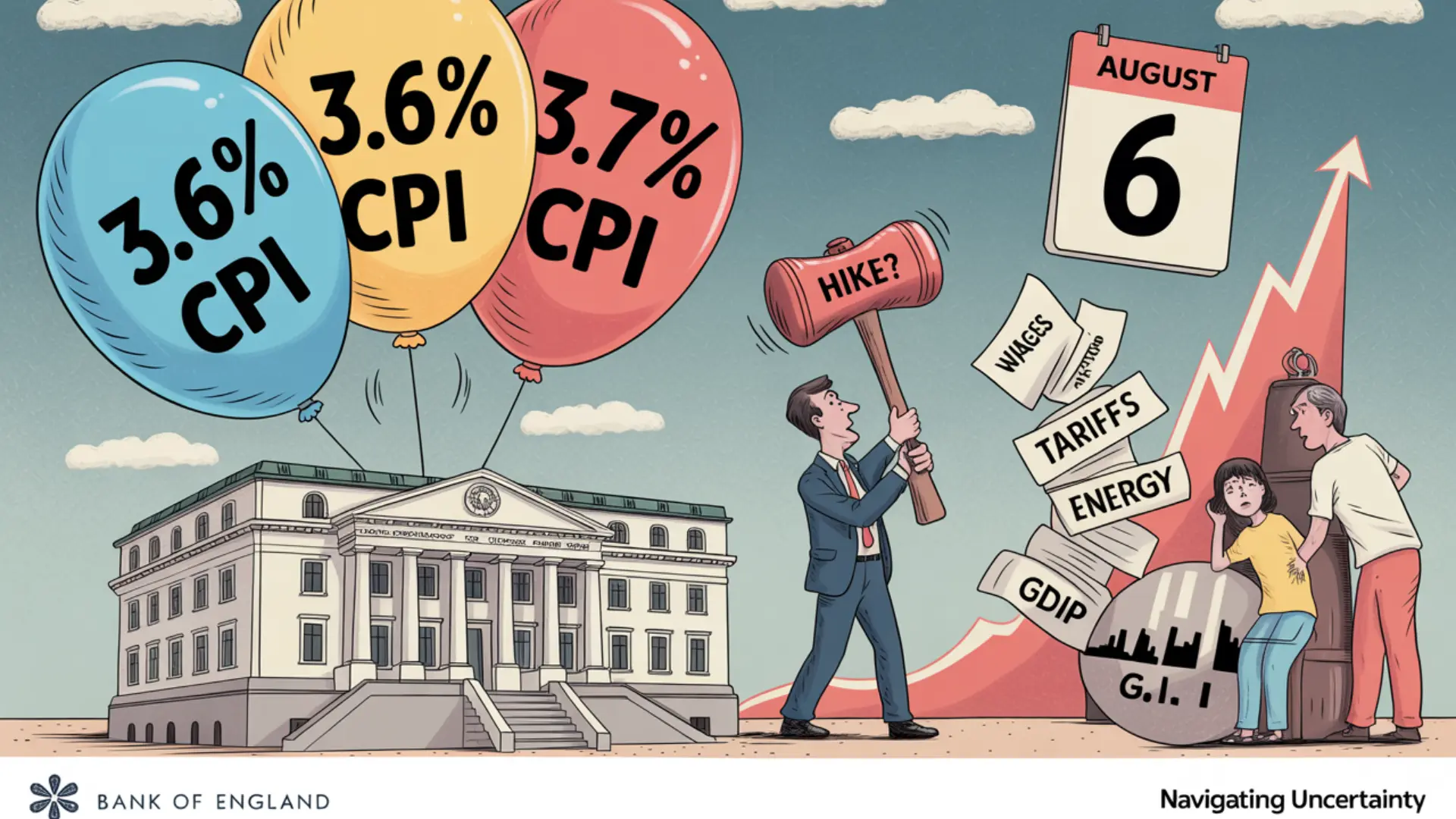

Annual consumer price inflation climbed to 3.6%, up from May’s 3.4% and well above the BoE’s 2.0% medium-term target. On a monthly basis, CPI rose 0.3%, matching forecasts.

Core CPI—which strips out volatile food and energy prices—increased by 0.4% month-on-month and 3.7% annually, compared to May’s 0.2% and 3.5% readings.

The persistent inflation pressure comes amid U.S. trade tariffs, rising employer costs such as higher minimum wages and National Insurance contributions, and elevated energy bills. These factors continue to strain household budgets and complicate the BoE’s policy path.

Meanwhile, GDP data for May showed the U.K. economy shrinking for the second straight month, adding to recession concerns. The central bank has cautioned that inflation could rise further this summer, despite core CPI briefly touching its target in May last year.

The Bank of England left its benchmark interest rate steady at 4.25% in June. The Monetary Policy Committee, which sets the nation’s interest rates, is scheduled to hold its next meeting on August 6.